Financial Flourishing: Cultivating a Secure Future Together

Just as we nurture our careers, we must also nurture our financial well-being. This month, let’s explore how to cultivate financial security and sow seeds for future success.

There are various valid reasons why financial literacy matters. From reducing stress and allowing you to focus on your career goals, to opening doors to new opportunities, such as starting a business or investing in your education. When your finances are in order, it empowers you to build a secure future for yourself and your family, and can allow for career changes, or taking calculated risks.

Now that you know why you need this, let me walk you through the practical steps you need to take for Financial Growth:

1.Budgeting and Tracking: Create a budget to track your income and expenses. You can use budgeting apps or spreadsheets to monitor your spending. This will help you see where your money is really going and how you can reduce unnecessary costs.

- Saving and Investing: Set aside a portion of your income for savings and investments. Explore different investment options, such as stocks, bonds, or real estate. When it comes to saving and investing, start where you are and with what you have. You can also learn about compounding interest, and make it work for you.

- Debt Management: If you’re in debt, carefully develop a sustainable plan to pay off any outstanding debt. Prioritize the debts with high-interest debt and make consistent payments till you’re out of it.

- Financial Planning: Set financial goals for the short and long term. Consider consulting with a financial advisor for personalized guidance.

- Continuous Learning:. Listen to financial podcasts and webinars. Stay informed about market trends and economic conditions. The more you learn, the more you know how to handle your finances and create wealth.

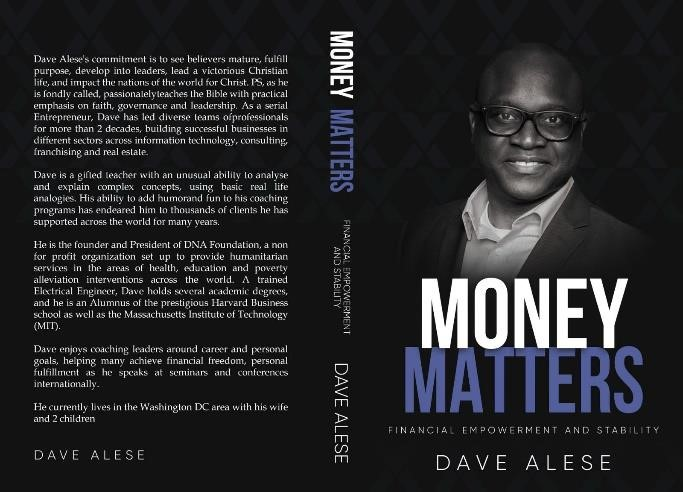

- Get a copy of the book “Money Matters” by Dave Alese and you can learn to take control of your financial future.

By cultivating financial literacy and practicing sound financial habits, we can create a strong foundation for our professional and personal success. Let April be the month to sow the seeds for a financially secure future.

Leave a Reply